| Introduction |

CRISIS AND LEVIATHAN: Critical Episodes in the Growth of American Government

CRISIS AND LEVIATHAN: Critical Episodes in the Growth of American Government

by Robert Higgs

Foreword by Arthur A. Ekirch, Jr.

Chapter 1: The Sources of Big Government:

A Critical Survey of Hypotheses

One of the most striking phenomena of modern times has been the steady growth of the government sector. Despite the hot political debates that have greeted the successive steps of government expansion, there is surprisingly little scientific understanding of the forces tending to bring it about.

—Jack Hirshleifer

We must have government. Only government can perform certain tasks successfully. Without government to defend us from external aggression, preserve domestic order, and define and enforce private property rights, few of us could achieve much. Unfortunately a government strong enough to protect us may be strong enough to crush us. In recognition of the immense potential for oppression and destruction, some consider government a necessary evil. Ludwig von Mises, an arch-libertarian but not an anarchist, disputed this characterization. “Government as such,” he declared, “is not only not an evil, but the most necessary and beneficial institution, as without it no lasting social cooperation and no civilization could be developed and preserved.” Like all who inherit the Lockean tradition, Mises believed that a strong but limited government, far from suffocating its citizens, allows them to be productive and free.1

For more than a century after its formation the United States had a government that approximated, perhaps as well as any actual government ever did, the ideal envisioned by Mises: strong but limited. Despite major shortcomings, especially its oppression of blacks and Indians, the government created a political and legal environment conducive to rapid economic development, fostering what Willard Hurst, the eminent legal historian, has called a "release of energy."2 Inventiveness, capital formation, and organizational innovation flourished as never before. Specialization and trade increased prodigiously. During the nineteenth century the nation became the world’s richest and freest society.

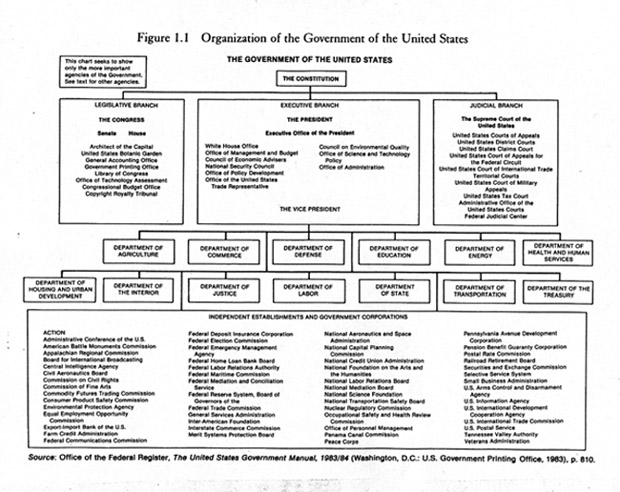

The nation’s second century, however, has witnessed a decline of the commitment to limited government and extensive private property rights. In 1900 the government still approximated a minimal state. Americans did not practice pure laissez-faire—no society ever did—but they still placed binding constraints on government and allowed relatively few projections of its power into the economic affairs of private citizens. That long-established restraint has largely dissolved during the past seventy years. Government now suffuses every aspect of economic and social life; it may now, as Warren Nutter said, “take and give whatever, whenever, and wherever it wishes.” Merely to list its numerous powers would require volumes: farms, factories, and stores; homes, schools, and hospitals; science and technology; even recreation and amusements—all feel its impact. Virtually nothing remains untouched by the myriad influences of governmental expenditure, taxation, and regulation, not to mention the government’s direct participation in economic activities.3 An abbreviated organizational chart for the federal government, shown here as Figure 1.1, suggests the gargantuan scope of modern government, even though it represents only a general outline of the activities undertaken at a single level of government.

How did this momentous transformation of American political, legal, and economic institutions occur? What motives and convictions inspired it? What socioeconomic developments promoted or obstructed it? Who expected to gain, or lose, as a result? What persons, elites, and interest groups played decisive roles? What circumstances allowed them to seize the helm of history? Did the growth of government proceed smoothly or episodically, and what forces shaped the profile of its change? I shall attempt to answer these questions.

My answers necessarily will leave much of the story untold. So many events and influences have had a bearing that nothing less than a comprehensive social, political, legal, and economic history of the past century could begin to answer all the pertinent questions. My objectives are more limited, partly because so much has already been done.

Several explanations of the growth of government have been advanced. Too often, however, the proponent of a particular hypothesis extols it as if no other wheel will roll. But many of the proposed explanations contain valid insights, and they are not necessarily mutually exclusive. Nothing is gained and much is lost by attempts to locate a single source of Big Government.4 I reject the approach that seeks a monocausal explanation. I shall strive instead to comprehend what the various hypotheses can and cannot explain, applying them selectively and using them as points of departure in developing my own ideas.

Figure 1.1 Organization of the Government of the United States

Unfortunately some explanations of the growth of government deal in abstractions that obscure the very nature of government. Some speak of the government as if it were One Big Nonhuman Thing, a gigantic man-eating machine. The Spanish philosopher José Ortega y Gasset, for example, said, “In our days the State has come to be a formidable machine … set up in the midst of society … anonymous … a machine whose existence and maintenance depend on the vital supports around it … sucking out the very marrow of society.” But for better or worse a government is itself human: it is simply the collectivity of persons who exercise legal authority.5

Treating government as One Big Nonhuman Thing, distinct and apart from the people, encourages misleading characterizations of what government is and does. Real governments cannot survive without the sustenance and support, or at least the tolerance, of nongovernmental people. Moreover, some people are always circulating between the rulers and the ruled. The American government includes several levels—federal, state, local, and hybrid; and several branches—legislative, executive, judicial, and hybrid. The sheer number of separate governmental entities belies a conception of government as a coherent institution. There are more than eighty thousand separate governments in the country today, more than sixty thousand with the power to tax.6 Obviously the multitude of people occupying positions of authority within these varied and numerous governments lack unity of purpose. Conflicts within government may be as common and significant as conflicts between the rulers and the ruled.7 Because no one in the huge, fragmented domain of authority can simply impose his will on all the others, governmental policies normally result from rivalry and struggle resolved through negotiations, compromises, deals, and pulling and hauling. We would do well to bear constantly in mind that the American government is and always has been not One Big Nonhuman Thing but rather many coexisting human institutions of varying function, scope, and authority.8 My concern in this book is mainly with the widening scope of the legislative, executive, administrative, and judicial powers exercised by the persons who constitute the federal government. One must remember that the growth of the federal government is only part of the story of the growth of government.

EXPLANATIONS OF THE GROWTH OF GOVERNMENT

Modernization

Reading between the lines of many historical works, one encounters the Modernization Hypothesis. It maintains that a modern urban-industrial economy simply must have an active, extensive government; that laissez-faire in the late twentieth century is unimaginable. Declamations about the absurdity of horse-and-buggy government in the Space Age or the impossibility of turning back the clock of history give rhetorical thrust to the idea. Exactly why a modern economy must be Big Government usually remains obscure.

Subscribers to the Modernization Hypothesis sometimes argue that a modern urban-industrial economy must have considerable governmental activity because it is so complex. “That the increased complexities and interrelationships of modern life necessitate this extension of the power of the state,” insisted Calvin Hoover, “is no less true because it is such a well-worn cliché.”9 No one denies that the economy has become more complicated. New products, technologies, and industries have proliferated. The population has grown and become more concentrated in urban areas. Interregional and international movement of goods, money, and financial instruments have multiplied. Increased specialization has made individuals less self-sufficient, and more dependent on a vast network of exchange.

Yet one cannot correctly infer that, merely because of growing complexities, economic affairs have required more governmental direction for their effective coordination. Many economists, from Adam Smith in the eighteenth century to Friedrich A. Hayek in the twentieth, have argued that an open market is the most effective system of socioeconomic coordination, the only one that systematically receives and responds to the ever-changing signals transmitted by millions of consumers and producers.10 This argument turns the Modernization Hypothesis on its head: while the government might be able to coordinate economic activities in a simple economy, it could never successfully do so in a complex one. The artificial shortages and gasoline lines of the United States in the 1970s—not to mention the chronic frustration of consumers in the socialist countries—give force to the critics’ argument.

How a market economy operates, of course, depends on the character and degree of the competition that propels it. Some observers believe that the emergence of large corporate firms in the late nineteenth century fundamentally altered the economy’s competitiveness, ushering in a new era. “This transformation of competition into monopoly,” wrote V. I. Lenin in 1916, “is one of the most important—if not the most important—phenomena of the modern capitalist economy.” Accepting this claim, one might interpret the growth of government during the late nineteenth and early twentieth centuries as a reaction, a development of “countervailing power,” by which the public resisted the higher prices, lower outputs, and distributional distortions that big business would have entailed under unregulated conditions. Representative events include the enactment of antirust laws and the creation of the Federal Trade Commission and the various industry-specific regulatory commissions such as the Interstate Commerce Commission and the Federal Communications Commission. In short, according to this interpretation, economic modernization fostered the growth of private monopoly power, and government grew more powerful to hold that pernicious, irresponsible power in check.11

The explanation is weak in both theory and fact. Many large corporate enterprises developed during the late nineteenth century, and the turn of the century witnessed a spate of mergers crowned by the creation of such industrial giants as United States Steel, American Tobacco, and International Harvester. But no one has ever established that the economy as a whole became substantially less competitive. Even within specific industries neither huge firms nor high industrial concentration ratios necessarily imply an absence of effective competition. The founders of the big firms sought monopoly power and profits, to be sure, but rarely did they succeed in gaining these objectives for long. The decisive aspects of competition are dynamic—chiefly technological and organizational innovation—and under conditions of dynamic competition neither a firm’s bigness nor an industry’s high concentration poses a serious threat to the welfare of the public.12 Furthermore, despite the almost exclusive attention lavished on manufacturing by analysts of the monopoly-power school, manufacturing is not the only important sector of the economy; nor is it in a relevant sense the “dominant” or the most “strategic” sector. Elsewhere—in wholesale and retail trade, for example—competition clearly increased enormously during the decades around the turn of the century. Consider how many local bastions of monopoly power must have been battered down by the advent of the mail-order distributors such as Sears, Roebuck & Company and Montgomery Ward. In many industries the monopolistic proclivities of large firms in concentrated industries were held in check by foreign competitors, actual or potential.

Besides, the government’s actions have tended more to preserve weak competitors than to assure strong competition. In this respect the historical performances of the FTC and many of the industry-specific regulatory commissions are notorious. As George Stigler has said, “Regulation and competition are rhetorical friends and deadly enemies: over the doorway of every regulatory agency save two should be carved: ‘Competition Not Admitted.’ The Federal Trade Commission’s doorway should announce, ‘Competition Admitted in Rear,’ and that the Antitrust Division, ‘Monopoly Only by Appointment.’”13 The government’s regulatory agencies have created or sustained private monopoly power more often than they have precluded or reduced it. This result was exactly what many interested parties desired from governmental regulation, though they would have been impolitic to have said so in public. The “one common conclusion” reached by historians of regulation is that “regulatory politics involved an intricate, complex, struggle among intensely competitive interest groups, each using the machinery of the state whenever it could, to serve particularistic goals largely unrelated to ‘public interest’ ideology except in the tactical sense.”14 But antitrust activities and the regulation of entry, prices, and services within industries—however one views their motivation and results—constitute a minor part of the multifarious activities of modern government.

Sometimes arguments in support of the Modernization Hypothesis make much of the population’s increased crowding. People living cheek by jowl inevitably create spillover costs, which economists call “negative externalities”; outsiders unwillingly share the costs of others’ actions. Pollution of air or water is a familiar example. If the legal system fails to define and enforce a private property right over every valuable resource, including clean air and water, then negative externalities may entail an inefficient pattern of production and resource use in the free market. For example, smoke from your factory smokestack may soil the clothing hanging on my clothesline, yet I cannot make you pay for the damages; nor can I effectively constrain or prevent further emissions. From a social point of view the activity of your factory is excessive because a portion of its true cost of operation is shifted without consent or compensation onto outsiders like me, who have no voice in determining how your factory is operated.

Governmental regulation conceivably can ameliorate such conditions. Whether historically it has done so has depended on how the government has framed and enforced its regulations, which has partly determined the magnitudes of the costs and benefits of its interventions. Proponents of the Modernization Hypothesis take for granted that negative externalities historically have been common and significant, that much governmental activity has been motivated by a desire to rectify such conditions, and that the interventions have routinely succeeded in bringing about a more efficient pattern of resource use. Each of the suppositions may be questioned. Some economists doubt that government can or will deal successfully with externalities. As Leland Yeager has said, government is itself “the prototypical sector in which decision makers do not take accurate account of all the costs as well as all the benefits of each activity.”15

No doubt some significant negative externalities have existed and some governmental interventions have been motivated by a desire to rectify baneful conditions. Public health regulations furnish the most compelling examples. Contagious diseases undoubtedly generate external costs: historically they caused tremendous harm; and government’s public health regulations were generally framed and enforced to bring about a more efficient condition.16 In recent decades, antipollution laws and enforcement bureaus such as the Environmental Protection Agency provide examples of the governmental attack on negative externalities, though the framing and enforcement of the environmental regulations raise many questions about their exact intent and about their success when all costs and benefits are taken into account.17

In sum, the Modernization Hypothesis has some, but not much, merit as an explanation of the emergence of Big Government. Regulation of industrial competition, public health, and environmental externalities makes up only a small part of what modern governments do. Most governmental activities have no plausible connection with the increased complexity of the economy, maintenance of competition, or the spillover costs that attend population concentration.18 Especially in application to the federal level, where governmental expansion has been most prodigious in the twentieth century, the Modernization Hypothesis has little to offer.

Public Goods

A related idea—it also involves nonexclusivity or spillover effects—has to do with public goods.. In the language of economics a “public good” is not simply or necessarily one supplied by government. Rather, it has the peculiar property of nonrivalry in consumption: its enjoyment by one consumer does not diminish its availability for the enjoyment of another. Once the public good has been produced, its use has no marginal cost, because its enjoyment by additional users requires no further sacrifice of valuable alternatives. National defense is not the most familiar example. If more protection from external aggression is provided, all citizens within the protected territory share the benefit of enhanced protection equally. My enhanced security does not entail diminished security for any other citizen.19

Public goods create a problem: because all consumers share their benefits fully, each consumer has an incentive to avoid paying for them. Each wishes to be a “free rider.” Where private goods are concerned, consumers who won’t pay for a good cannot enjoy it, because those who do pay can exclude others from sharing in its benefits. For some public goods, however, the exclusion of nonpaying beneficiaries is either impossible or prohibitively costly. When foreign enemies are deterred from aggression against the United States, every person in the country receives the protection equally; and the all-inclusiveness can scarcely be avoided. Left to provide a nonexclusive public good in the market, people would provide little or nothing. As everyone held back, hoping to be the unexcludable free rider, no provision at all would be made.

Government can break the stalemate created by the free-rider problem. By taxing all—or at least a sufficient number—of the beneficiaries of a public good, it can obtain the funds to pay for the good. Thorny issues remain even after government intervenes, because the appropriate amount of provision and the proper apportionment of the tax burden cannot be determined by any straightforward and practical procedure. In practice the political process determines how much is provided and how the costs are shared by the citizens.20

The Public Goods Hypothesis asserts that during the twentieth century the costs of producing nonexclusive public goods—chiefly national defense and the technology associated with modern warfare—have grown and, as only government can assure the production of these goods, government has grown correspondingly. The argument has considerable merit—particularly with reference to the federal government, where the provision of national defense is concentrated. Certainly the twentieth century has witnessed extraordinary international instability and hostility. Two world wars, a host of smaller international conflicts, and the Cold War have elevated the demand for the services of the military establishment far above its nineteenth-century levels. At the same time the development of modern military technology has made the production of national security enormously more costly. Since World War II an ongoing arms race has meant that national security cannot be achieved once and for all, as each round of action and reaction alters the requirements for effective deterrence.

Still, notwithstanding its clear pertinence, the Public Goods Hypothesis provides only a partial explanation of the growth of government. Even at the federal level, most governmental expenditures have no direct relation to national defense. The massive outlays for old-age pensions, unemployment benefits, public housing, job training, medical care, agricultural subsidies, school lunches, and so on—not to mention the hydra-headed regulation of everything from children’s pajama fabrics to commodity futures contracts—have no connection with national defense or other nonexclusive public goods.

The Welfare State

The United States has developed not simply a large government but a welfare state. One may employ a variant of the Modernization Hypothesis to explain this aspect of the rise of Big Government. Economic growth and the concomitant socioeconomic transformation have tended in various, often indirect, ways to diminish the social-service roles formerly played by such private institutions as families, churches, and voluntary associations. Victor Fuchs has argued that the “fruits of the market system—science, technology, urbanization, affluence”—have undermined the institutions on which the social order formerly rested. “With the decline of the family and of religion, the inability of the market system to meet such needs becomes obvious, and the state rushes in to fill the vacuum.” Bigger government becomes a “substitute for family or church as the principal institution assisting individuals in time of economic or social misfortune.”21 No doubt the substitution of governmental social services for private social services has occurred on a wide front. But Fuchs’s remarks stop short of exploring exactly how the wide-ranging substitution has been effected. One needs to know who benefits and who pays, how much and in what ways.

Wilhelm Ropke, like Fuchs and many others, viewed the modern welfare state as “without any doubt, an answer to the disintegration of genuine communities during the last one hundred years.” But he also recognized that “[t]oday’s welfare state is not simply an improved version of the old institutions of social insurance and public assistance.” Rather, it has become “the tool of a social revolution” where “[t]aking has become at least as important as giving,” and “it degenerates into an absurd two-way pumping of money when the state robs nearly everybody and pays nearly everybody, so that no one knows in the end whether he has gained or lost in the game.”22 The welfare state has become, if it was not from the beginning, the redistributional state. Governmental policies for the limited purpose of saving the most unfortunate citizens from destitution have merged into governmental policies for the unlimited purpose of redistributing income and wealth among virtually all groups, rich as well as poor.

Political Redistribution

An explanation of how “the state rushes in to fill the vacuum,” transforming the welfare state into something far more comprehensive and penetrating, is the Political Redistribution Hypothesis. This argument views government as an instrument for the coercive redistribution of wealth. Often it portrays the voters as highly knowledgeable and narrowly self-interested and the elected officials as sensitively responsive to clear messages sent them by the voters. The argument has taken various forms.

In Allan Meltzer and Scott Richard’s version it maintains that Big Government “results from the difference between the distribution of votes and the distribution of income. Government grows when the franchise is extended to include more voters below the median income or when the growth of income provides revenues for increased redistribution.”23 The explanation fits the historical facts poorly. Extensions of the franchise apparently have had no independent effect on the growth of government, and the most dramatic extensions of governmental power have occurred in periods of stagnant or falling real civilian income, during the world wars and the trough of the Great Depression. Furthermore, to assume that government always transfers income to lower-income recipients flies in the face of facts too numerous and familiar to require recitation. As Mancur Olson has observed, governmental redistributions typically “have arbitrary rather than egalitarian impacts on the distribution of income—more than a few redistribute income from lower to higher income people.” Many governmental activities are "of no special help to the poor" and many others “actually harm them.”24

Sam Peltzman’s version of the Political Redistribution Hypothesis holds that “governments grow where groups which share a common interest in that growth and can perceive and articulate that interest become more numerous.” Here governmental growth is seen as driven exclusively by citizen demands, governmental response being taken for granted. Peltzman maintains that “the leveling of income differences across a large part of the population … has in fact been a major source of the growth of government in the developed world over the last fifty years” because the leveling created “a broadening of the political base that stood to gain from redistribution generally and thus provided a fertile source of political support for expansion of specific programs. At the same time, these groups became more able to perceive and articulate that interest … [and] this simultaneous growth of ‘ability’ served to catalyze politically the spreading economic interest in redistribution.”25

The apparent sophistication of Peltzman’s mathematically specified and econometrically tested model dissolves under close inspection. His approach is to “treat government spending and taxing as a pure transfer” and to “assume that the amount of spending is determined entirely by majority-voting considerations … that political preferences are motivated purely by self-interest … [and that] each voter understands costlessly the details of a proposed policy and its implications for his well being.” In another version of the model, intended to be more realistic, Peltzman relaxes these stringent conditions slightly, assuming that only one group of voters is fully informed while all the others are completely ignorant and either stay away from the polls or vote randomly. Such assumptions cannot support a convincing explanation of the growth of government. The dubious data and auxiliary assumptions used by Peltzman to implement his econometric tests do nothing to reassure the reader troubled by the highly unrealistic specification of the underlying model.26

Unlike the Modernization, Public Goods , and Welfare State Hypotheses, which implicitly assume that government grows automatically in the service of a broad but changing “public interest,” the Political Redistribution Hypothesis explicitly views the growth of government as the product of political actions. (Political actions = seeking or wielding the coercive powers of government in order to determine who gets what, when, how.) That perspective is, in any realistic account, indispensable. But in many of its detailed formulations, as we have just seen, the argument characterizes politics in a highly stylized, grotesquely unrealistic way. It usually assumes that the size of government is determined exclusively by elected officials seeking reelection. Where are the Supreme Court and the fundamental restraints of the Constitution and conservative public opinion? What roles are the permanent "civil service" officials of the executive branch and the independent regulatory agencies presumed to play?27

Certainly the assumption of fully informed voters is untenable and misleading. To assume that the typical voter is completely ignorant would approximate the truth more closely. An authority on public opinion has reported that Americans can name their astrological sign more readily than they can name their representative in Congress. To suppose that political actors know precisely how an electoral outcome will be linked to a specific policy action and hence to a particular redistribution of wealth is to push the assumption of complete knowledge to an absurdly fictitious extreme. As James Buchanan has observed, “The electoral process offers, at best, a crude disciplinary check on those who depart too much from constituency preferences.” Elections occur infrequently. Few citizens possess much accurate information about political issues or the actions of politicians; nor do many citizens have much incentive to inform themselves better. Public choice theorists, the scholars who study politics by using the methods of economics, call this lack of knowledge “rational ignorance.” Rational or not, its effect is the same: “almost any politician can, within rather wide limits, behave contrary to the interests of his constituents without suffering predictable harm.”28

Most likely the politician will behave contrary to the interests of his constituents even if he wants to serve them faithfully. Apart from the heterogeneity of the constituents’ interests—and the consequent impossibility of serving all or perhaps even a sizable minority of them—the information problem is simply overwhelming. Political scientists, more often than economists, recognize the problem and emphasize “the practical difficulties legislators experience in discovering what their constituents’ interests really are.”29

The slippage between the interests of constituents actions of their elected officials can be readily confirmed, sometimes in an amusing way. Reagan’s first budget director, the former congressman David Stockman, provided a charming example in his notorious confessions: “I went around and cut all the ribbons,” he said, “and they never knew I voted against the damn programs.” Congressman Pete McCloskey made the same point in recalling his first congressional victory. A postelection survey, intended to demonstrate the victorious candidate’s mandate, revealed, as McCloskey put it, “that 5% of the people voted for me because they agreed with my views; 11% voted for me even though they disagreed with my views, and 84% didn’t have any idea what the hell my views were.”30

In sum, one has many good reasons to agree with Joseph Schumpeter’s assessment: “The freely voting rational citizen, conscious of his (long-run) interests, and the representative who acts in obedience to them—is this not the perfect example of a nursery tale?”31 Political actions commonly take place in an environment of ignorance, misinformation, posturing, and heated emotions; there are long seasons of lassitude and maneuvering punctuated by brief episodes of frenzied action. In the formulation of detailed policy, the voters at large do not count for much. Strategically placed leaders and interested elites constantly apprised of each moment’s political potential are more decisive. Moreover, ideologically motivated actions may drive the course of political events far more than proponents of the Political Redistribution Hypothesis recognize.

Ideology

Many scholars maintain some form of the Ideology Hypothesis to explain the growth of government. The idea is that true believers, committed to a vision of the Good Society, have sought and obtained expanded governmental powers in order to shape social reality in conformity with their ideals. Supporters of the hypothesis make unlikely confederates. They include John Maynard Keynes, the patron saint of modern liberalism, who asserted that “the ideas of economists and political philosophers … are more powerful than is commonly understood. Indeed the world is ruled by little else … [S]oon or late, it is ideas, not vested interests, which are dangerous for good or evil.”32 Another firm believer in the force of ideas is Friedrich A. Hayek, perhaps the most celebrated intellectual on the right. He has identified the ultimate cause of the abandonment of the market system as “certain new aims of policy,” in particular a conviction that government should “determine the material position of particular people or enforce distributive or ‘social’ justice” by means of “an allocation of all resources by a central authority.”33 Thus Keynes, who argued in favor of a “somewhat comprehensive socialization of investment,” and Hayek, who has devoted a long professional life to combating socialism of any sort, agree that the growth of government depends ultimately on ideas or, more accurately, ideologies.34

Ideology, which some refer to more vaguely as “public opinion,” must have played an important part, at least a decisive permissive role. As Ortega y Gasset has said and many others have recognized, “there can be no rule in opposition to public opinion.”35 If people generally had opposed Big Government on principle, free markets could scarcely have been abandoned as they have been during the past seventy years. Once can easily document the shift of public opinion toward the left during the twentieth century. Examining evidence from numerous sample-surveys, Herbert McClosky and John Zaller recently confirmed “a virtual turnabout in American attitudes toward laissez-faire over a period of fifty to seventy-five years.”36

Because ideologies are intangible and difficult to gauge, one must tread lightly in arguing about their effects. Yet much can be established, especially when one recognizes that opinion leaders have the ability to guide the beliefs of the masses. Public opinion, a political scientist has observed, is “often vague, transitory, and inconsistent … In so far as the public is aware of issues, it focuses frequently on issues and topics which have been promoted or popularized by politicians and the media.” The views of a Walter Lippmann or a Walter Cronkite, not to mention a Franklin D. Roosevelt, can do more to determine the climate of opinion than the views of millions of less respected and less strategically situated people can do—consider that despite his faltering delivery and often faulty logic, Ronald Reagan gained a reputation as the Great Communicator. “[I]n a mass democracy,” Ropke wrote, “policy has to withstand … the pressure of … mass opinions, mass emotions, and mass passions,” but these are “guided, inflamed, and exploited by pressure groups, demagogy, and party machines alike.”37 By concentrating on the ides disseminated by strategically placed elites and influential persons, one has a more defensible basis for generalizations about the prevailing ideologies that matter. (What has caused the historical twists and turns of ideology among opinion leaders themselves is a separate question.)

Even if the dominant ideologies can be identified, however, one must recognize that a legislature “is not a factory that mechanically converts opinion into statutes.”38 Just as there is much slippage between the economic interests of constituents and the actions of their political representatives, there is much slippage between the opinions or ideologies of constituents and the actions of their political representatives. To understand the discrepancy would be to understand a great deal of the reality of the workings of modern representative democracy. Conceivably it occurs in part because some public officials try to promote the “public interest,” which has been described as “broad-gauged, inclusive conceptions of what constitutes the best interests of the societal groups who support them or of society as a whole … something other than the summation, processing, or mediation of societal interests.39 Another part of the slippage may result from nothing more than simple venality, as governmental officials serve the highest bidder. One can only speculate whether the occasional cases of outright bribery that come to light are just the tip of a skunk’s tail. Some scholars consider direct bribes a “significant mechanism” in the determination of the actions of governmental agents. Others doubt the importance of direct bribes, mainly because of the “greater ease and legality of bribing policymakers indirectly.”40

In any event, ideology is not simply an independent variable in the sociopolitical process. Schumpeter perceived this complication when he observed that “whether favorable or unfavorable, value judgments about capitalist performance are of little interest. For mankind is not free to choose … Things economic and social move by their own momentum and the ensuing situations compel individuals and groups to behave in certain ways whatever they may wish to do—not indeed by destroying their freedom of choice but by shaping the choosing mentalities and by narrowing the list of possibilities from which to choose.”41 Some may object that this declaration goes too far, that it is unjustifiably deterministic, leaving no room at all for ideology as an independent variable.42 Still, in his provocative formulation of the sociology of knowledge in relation to the growth of government, Schumpeter identified a critical issue and laid down an analytical challenge that any fully satisfying account will have to meet.

Crisis

The final explanation of the growth of government to be considered here is the Crisis Hypothesis. This maintains that under certain conditions national emergencies call forth extensions of governmental control over or outright replacement of the market economy. Supporters of the hypothesis assume that national emergencies markedly increase both the demand for and the supply of governmental controls. “At the time of economic crisis,” observed Calvin Hoover, “when critical extensions of governmental power are likely to occur … there is little opportunity for a meaningful vote on whether or not, as a matter of principle, the powers of the state should be extended. Instead, there is likely to be an insistent demand for emergency action of some sort and relatively little consideration of what the permanent effect will be.”43

In American history the most significant crises have taken two forms: war and business depression. At the outbreak of war a suddenly heightened demand for governmental provision of military activities leads immediately to displacement of market-directed resource allocation by greater taxation, governmental expenditure, and regulation of the remaining civilian economy. The larger and longer is the war, the greater is the suppression of the market economy. Modern “total” war, widely regarded as jeopardizing the nation’s very survival, also encourages a lowering of the sturdiest barriers—constitutional limitations and adverse public opinion—that normally obstruct the growth of government. In severe business depressions many people come to believe that the market economy can no longer function effectively and that an economy more comprehensively planned or regulated by government would operate more satisfactorily. Hence they give greater support to political proposals for enlarged governmental authority and activity. Though to a lesser degree than during wartime, changes in public opinion during depressions may also stimulate the supply of new governmental interventions by demanding, approving, or at least condoning facilitative reinterpretations of the Constitution. (Note that once constitutional barriers have been lowered during a crisis, a legal precedent has been established giving government greater potential for expansion in subsequent noncrisis periods, particularly those that can be plausibly described as crises.)

Some scholars have rejected the Crisis Hypothesis completely because by itself it cannot explain all of the growth of government; they have in effect rejected the hypothesis because the evidence appears to show that, although crisis may have been a sufficient condition for governmental expansion, it has not been a necessary condition. Judged by this standard, however, every existing hypothesis would be found wanting. Sometimes the Crisis Hypothesis has been rejected because the growth of government, as measured by a quantitative index such as spending or employment, appears less than perfectly correlated with the sequence of crisis episodes. Such a simpleminded basis for rejection of the hypothesis fails to appreciate the various ways in which crisis may promote the rise of government and ignores the possibility of lags between the occurrence of the crisis and the appearance of some of its effects. Some scholars have rejected the hypothesis because it cannot account for the growth of government in all countries, as if no explanation with less than universal validity has any pertinence at all.

In fact, governmental expansion historically has been highly concentrated in a few dramatic episodes, especially the world wars and the Great Depression. A major virtue of the Crisis Hypothesis, a virtue that it alone appears to possess, is that it conforms fairly well to the most prominent contours of the historical experience. To employ the hypothesis to best advantage, however, one must look beyond the crises themselves. One must discover why the expansions of governmental power during a crisis do not disappear completely when normal socioeconomic conditions return. And one must explain why crises led to upward-ratcheting governmental powers in the twentieth century but not in the nineteenth, which had its own emergencies. Accounting for this difference requires that some of the other hypotheses be brought into play as complements of the Crisis Hypothesis.

CONCLUSIONS

Big Government in the United States has various sources. Not all are equally important, but scholars have yet to develop analytical procedures for determining with precision their relative importance. Given the many intricate interdependencies among the various sources, such a determination may be beyond our grasp conceptually as well as empirically. Ameliorating negative externalities, providing nonexclusive public goods, guaranteeing the livelihood of the most unfortunate citizens, redistributing income and wealth, pursuing the elusive goals of influential ideologies, reacting to crises—such are the activities of modern Big Government. They are related differently to any particular stimulus or obstruction. Only by detailed historical study can one hope to understand the complexities of the growth of American government.

Notes:

1. Ludwig von Mises, The Ultimate Foundation of Economic Science: An Essay on Method (Kansas City, Kans: Sheed Andrews and McMeel, 1978), p. 98. Also Frank H. Knight, Freedom and Reform: Essays in Economics and Social Philosophy (Indianapolis: Liberty Press, 1982), p. 232.

2. James Willard Hurst, Law and the Conditions of Freedom in the Nineteenth-Century United States (Madison: University of Wisconsin Press, 1956), pp. 3-32 and passim. Also idem, Law and Markets in United States History: Different Modes of Bargaining Among Interests (Madison: University of Wisconsin Press, 1982), pp. 96, 124-125; Lawrence M. Friedman, A History of American Law (New York: Simon & Schuster, 1973).

3. G. Warren Nutter, Political Economy and Freedom: A Collection of Essays (Indianapolis: Liberty Fund, 1983), pp. 51-52. Useful general accounts of the growth of American government in the twentieth century include Solomon Fabricant, The Trend of Government Activity in the United States since 1900 (New York: National Bureau of Economic Research, 1952) and Jonathan R. T. Hughes, The Governmental Habit: Economic Controls from Colonial Times to the Present (New York: Basic Books, 1977), pp. 126-242. The most revealing descriptions of the vast scope of modern government have been produced not by scholars but unwittingly by the authors of “helpful guides” for citizens seeking governmental benefits, for example, William Ruder and Raymond Nathan, The Businessman’s Guide to Washington (New York: Collier Books, 1975) and The Encyclopedia of U.S. Government Benefits, ed. Roy A. Grisham, Jr., and Paul D. McConaughy (New York: Avon Books, 1975). For a straightforward agency-by-agency description of the contemporary federal government, see Office of the Federal Register, The United States Government Manual, 1983/84 (Washington, D.C.: U.S. Government Printing Office, 1983).

4. James E. Alt and K. Alec Chrystal, Political Economics (Berkeley: University of California Press, 1983), pp. 190, 243. In a recent econometric study, David Lowery and William D. Berry tested nine different explanations of the growth of governmental spending in the postwar United States and found that, considered separately, only one “receive[d] even a minimal degree of support”—and even that one, because of econometric problems in the test, was questionable. “The Growth of Government in the United States: An Empirical Assessment of Competing Explanations,” American Journal of Political Science 27 (Nov. 1983): 665-694 (quotation from 686).

5. José Ortega y Gasset, The Revolt of the Masses (New York: Norton, 1957), pp. 119-121. Ortega y Gasset recognized (p. 122) that “for all that the State is composed of the members of that society,” but few lines later he wrote of “what State intervention leads to: the people are converted into fuel to feed the mere machine which is the State.” I agree with John R. Commons that “the officials-in-action- … constitute the state-in-action … [whereas] the legal relations … are formal statements of ideals, wishes and hopes which may or may not be realized when the officials come to act.” Legal Foundations of Capitalism (Madison: University of Wisconsin Press, 1959), p. 123.

6. Thomas R. Dye and L. Harmon Zeigler, The Irony of Democracy: An Uncommon Introduction to American Politics, 5th ed. (Monterey, Calif.: Duxbury Press, 1981), pp. 327, 431; Graham K. Wilson, Interest Groups in the United States (Oxford: Clarendon Press, 1981), pp. 132-133.

7. Two (highly partisan) blow-by-blow accounts of recent governmental infighting are Paul Craig Roberts, The Supply-Side Revolution: An Insider’s Account of Policymaking in Washington (Cambridge, Mass.: Harvard University Press, 1984) and David A. Stockman, The Triumph of Politics: How the Reagan Revolution Failed (New York: Harper & Row, 1986).

8. Eric A. Nordlinger, On the Autonomy of the Democratic State (Cambridge, Mass.: Harvard University Press, 1981), p. 15; Lance T. LeLoup, Budgetary Politics (Brunswick, Ohio: King’s Court Communications, 1980), p. 21.

9. Calvin B. Hoover, The Economy, Liberty, and the State (New York: Twentieth Century Fund, 1959), p. 373. Echoing this refrain, Morton Keller recently declared: “A complex and ever changing economy requires a dense and flexible regulatory system.” See “The Pluralist State: American Economic Regulation in Comparative Perspective, 1900-1930” in Regulation in Perspective: Historical Essays, ed. Thomas K. McCraw (Cambridge, Mass.: Harvard University Press, 1981), p. 94. Among economists the Modernization Hypothesis often appears in the form of Wagner’s Law. For a sensible critique of this vague notion, see Alan T. Peacock and Jack Wiseman, The Growth of Public Expenditures in the United Kingdom (Princeton, N.J.: Princeton University Press, 1961), pp. 16-20, 24-28.

10. Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations (New York: Modern Library, 1937); F. A. Hayek, Law Legislation and Liberty: A New Statement of the Liberal Principles of Justice and Political Economy, Vol. I, Rules and Order (Chicago: University of Chicago Press, 1973), pp. 35-54, esp. pp 50-51. Also Thomas Sowell, Knowledge and Decisions (New York: Basic Books, 1980), esp. pp. 214-223; Israel M. Kirzner, “Economic Planning and the Knowledge Problem,” Cato Journal 4 (Fall 1984): 407-418. Compare Leonid Hurwicz, “Economic Planning and the Knowledge Problem: A Comment,” ibid., pp. 419-425.

11. The thesis is developed by John Kenneth Galbraith, American Capitalism: The Concept of Countervailing Power, 2nd ed. (Boston: Houghton Mifflin, 1956), esp. pp. 135-153 on “Countervailing Power in the State.” Lenin’s statement from Imperialism: The Highest State of Capitalism, new rev. trans. (New York: International Publishers, 1939), p. 17.

12. Joseph A. Schumpeter, Capitalism, Socialism, and Democracy, 3rd ed. (New York: Harper & Row, 1950), pp. 81-106; Israel M. Kirzner, Competition and Entrepreneurship (Chicago: University of Chicago Press, 1973), esp. pp. 125-131. Also Thomas K. McCraw, “Rethinking the Trust Question,” in Regulation in Perspective, ed. McCraw, pp. 1-24. J. R. T. Hughes has suggested to me that even if the threat actually posed by big business was not genuine, people might still have (mistakenly) feared it and therefore sought governmental protection from it.

13. George J. Stigler, The Citizen and the State: Essays on Regulation (Chicago: University of Chicago Press, 1975), p. 183. For surveys of studies of a wide variety of regulatory programs, see Thomas K. McCraw, “Regulation in America: A Review Article,” Business History Review 49 (Summer 1975): 159-183, and Bernard H. Siegan, Economic Liberties and the Constitution (Chicago: University of Chicago Press, 1980), pp. 283-303. In “Rethinking the Trust Question,” McCraw concludes (p. 55) that “economic regulation typically has not been the ally but the enemy of competition.”

14. McCraw, “Regulation in America,” p. 171.

15. Leland B. Yeager, “Is There a Bias Toward Overregulation?” In Rights and Regulation: Ethical, Political, and Economic Issues, ed. Tibor R. Machan and M. Bruce Johnson (Cambridge, Mass.: Ballinger, 1983), p. 125.

16. Edward Meeker, “The Social Rate of Return on Investment in Public Health, 1880-1910,” Journal of Economic History 34 (June 1974): 392-431; Robert Higgs, The Transformation of the American Economy, 1865-1914: An Essay in Interpretation (New York: Wiley, 1971), pp. 67-72; idem, “Cycles and Trends of Mortality in 18 Large American Cities, 1871-1900,” Explorations in Economic History 16 (Oct. 1979): 396-398.

17. Murray L. Weidenbaum, Business, Government, and the Public, 2nd ed. (Englewood Cliffs, N.J.: Prentice-Hall, 1981), pp. 92-113; Douglas F. Greer, Business, Government, and Society (New York: Mcmillan, 1983), pp. 463-489.

18. Thomas E. Borcherding, “The Sources of Growth of Public Expenditures in the United States, 1902-1970,” in Budgets and Bureaucrats: The Sources of Government Growth, ed. Thomas E. Borcherding (Durham, N.C.: Duke University Press, 1977), p. 53; William A. Niskanen, “The Growth of Government,” Cato Policy Report 7 (July/Aug. 1985): 8-10; Edgar K. Browning and Jacquelene M. Browning, Public Finance and the Price System, 2nd ed. (New York: Macmillan, 1983), pp. 93, 98. Also the sources cited in note 3 above, especially the “helpful guides.”

19. Because national defense so often exemplifies the concept of a public good, it is well to note that “[d]efense spending also confers private benefits in significant amounts, and those considerations often cloud the issues concerning defense as a public good … The amount of defense spending does not translate into a certain level of capability. But as long as defense spending also provides substantial private benefits, there will be strong pressures to continue to increase expenditures.” LeLoup, Budgetary Politics, pp. 253, 255. Milton and Rose Friedman have observed that “[t]he iron triangle”—in this case consisting of the Pentagon, the defense contractors, and the pertinent congressmen—“is as powerful in the military area as it is in the civilian area.” Milton Friedman and Rose Friedman, Tyranny of the Status Quo (New York: Harcourt Brace Jovanovich, 1984), p. 78.

20. Browning and Browning, Public Finance, pp. 29-34, 42-44, 49-50; Joseph P. Kalt, “Public Goods and the Theory of Government,” Cato Journal 1 (Fall 1981): 565-584; Russell D. Roberts, “A Taxonomy of Public Provision,” Public Choice 47 (1985): 267-303. Compare E. C. Pasour, Jr., “The Free Rider as a Basis for Government Intervention,” Journal of Libertarian Studies 5 (Fall 1981): 453-464.

21. Victor R. Fuchs, “The Economics of Health in a Post-Industrial Society,“ Public Interest (Summer 1979): 19, 13. For provocative variations on the theme, see Robert Nisbet, Twilight of Authority (New York: Oxford University Press, 1975), esp. pp. 230-287.

22. Wilhelm Ropke, A Humane Economy: The Social Framework of the Free Market, trans. Elizabeth Henderson (Chicago: Henry Regnery, 1971), pp. 156, 164-165. Also Mancur Olson, The Rise and Decline of Nations: Economic Growth, Stagflation, and Social Rigidities (New Haven, Conn.: Yale University Press, 1982), p. 174.

23. Allan H. Meltzer and Scott F. Richard, “Why Government Grows (and Grows) in a Democracy,” Public Interest (Summer 1978): 116. Also, by the same authors, “A Rational Theory of the Size of Government,” Journal of Political Economy 89 (Oct. 1981): 914-927. The latter article measures the size of government by the share of income redistributed. Given the multitude of indirect as well as direct ways that governmental policies effect redistributions, the mesure is not operational and hence the hypothesis cannot be tested empirically. A subsequent paper by Meltzer and Richard fails to recognize the problem and its test of the authors’ hypothesis is therefore unpersuasive. “Tests of a Rational Theory of the Size of Government,” Public Choice 41 (1983): 403-418.

24. Olson, Rise and Decline, p. 174.

25. Sam Peltzman, “The Growth of Government,” Journal of Law and Economics 23 (Oct. 1980): 285, emphasis in original.

26. Ibid., pp. 221-223, 233-234. Political scientist Morris P. Fiorina has aptly remarked that “most economists receive a tolerably good training in statistical method, so they are capable of producing analyses which have the appearance of thoroughness and sophistication, but … their lack of contextual knowledge leads them to rely on naïve model specification. Often, too, public choice empirical studies utilize outrageous indicators for crucial theoretical variables.” Fiorina’s “Comments,” in Collective Decision Making: Applications from Public Choice Theory, ed. Clifford S. Russell (Baltimore: Johns Hopkins University Press, 1979), p. 48. Unrepentant, Peltzman has recently provided another example of what Fiorina was criticizing: “An Economic Interpretation of the History of Congressional Voting in the Twentieth Century,” American Economic Review 75 (Sept. 1985): 656-675.

27. On the Supreme Court, see Siegan, Economic Liberties, and Paul L. Murphy, The Constitution in Crisis Times, 1918-1969 (New York: Harper Torchbooks, 1972). On conservative (and other) public opinion, see Chapters 3 and 4 below and sources cited there. On the bureaucracy, see Browning and Browning, Public Finance, pp. 72-75; Dye and Zeigler, Irony of Democracy, pp. 323-324, 335; Samuel P. Hayes, “Political Choice in Regulatory Administration,” in Regulation in Perspective, ed. McCraw, pp. 124-154; Francis E. Rourke, Bureaucracy, Politics, and Public Policy, 2nd ed. (Boston: Little, Brown, 1976), pp. 179-184 and passim. For a clever if less than compelling argument that the bureaucracy is actually more subservient to the legislature than it appears to be, see Barry R. Weingast, “The Congressional-Bureaucratic System: A Principal Agent Perspective (with applications to the SEC),” Public Choice 44 (1984): 147-191.

28. W. Lance Bennett, Public Opinion in American Politics (New York: Harcourt Brace Jovanovich, 1980), pp. 43-45, 122-123, 350, 384-390 (quotation from p. 44); James M. Buchanan, “Why Does Government Grow?” in Budgets and Bureaucrats, ed. Borcherding, p. 13. Also James. M. Buchanan, The Limits of Liberty: Between Anarchy and Leviathan (Chicago: University of Chicago Press, 1975), pp. 156-161; Browning and Browning, Public Finance, pp. 54-72; Alt and Chrystal, Political Economics, pp. 154, 155, 161; Siegan, Economic Liberties, pp. 91, 265-282; Olson, Rise and Decline, p. 52; Nordlinger, Autonomy, pp. 87, 96, 209; Graham K. Wilson, Interest Groups, pp. 110, 117, 125; Dye and Zeigler, Irony of Democracy, pp. 193, 196, 362, 364, 367; Brian Barry, Sociologists, Economists and Democracy (Chicago: University of Chicago Press, 1978), pp. 127, 135; Joseph D. Reid, Jr., “Understanding Political Events in the New Economic History,” Journal of Economic History 37 (June 1977): 308, 313-314; Leland B. Yeager, “Rights, Contract, and Utility in Policy Espousal,” Cato Journal 5 (Spring/Summer 1985): pp. 284-285.

29. Wilson, Interest Groups, p. 117 (also pp. 110, 125). The economists’ typical presumption appears starkly in Gary Becker’s recent contribution, where “politicians and bureaucrats [are] assumed to be hired to further the collective interests of pressure groups, who fire or repudiate them by elections and impeachment when they deviate excessively from those interests.” See “A Theory of Competition among Pressure Groups for Political Influence,” Quarterly Journal of Economics 98 (Aug. 1983): 396. Does this tight control include firing a civil service bureaucrat or impeaching a Supreme Court justice? If so, some intractable problems are assumed away; if not some important actors are left out of the model.

30. William Greider, “The Education of David Stockman,” Atlantic Monthly 248 (Dec. 1981): 30; “Pete McCloskey: Trying to Run on the Issues,” Wall Street Journal, June 3, 1982, p. 22.

31. Joseph A. Schumpeter, History of Economic Analysis (New York: Oxford University Press, 1954), p. 429.

32. John Maynard Keynes, The General Theory of Employment, Interest and Money (New York: Harcourt, Brace & World, 1936), pp. 383-384.

33. Friedrich A. Hayek, The Constitution of Liberty (Chicago: University of Chicago Press, 1960), pp. 231-232.

34. Midway between Keynes and Hayek on the political spectrum, the Friedmans also espouse an ideological-change explanation of the growth of government (Tyranny of the Status Quo, pp. 37-38). On ideology in relation to the changing role of government, see Chapters 3 and 4 below and the sources cited there.

35. Ortega y Gasset, The Revolt of the Masses, p. 128 (also p. 126). Also Knight, Freedom and Reform, pp. 235, 414.

36. Herbert McClosky and John Zaller, The American Ethos: Public Attitudes toward Capitalism and Democracy (Cambridge, Mass: Harvard University Press, 1984), p. 159.

37. Wilson, Interest Groups, p. 11; Ropke, A Humane Economy, p. 142. Ortega y Gasset agreed that “[t]he majority of men have no opinions, and these have to be pumped into them from outside.” Also, “Under universal suffrage, the masses do not decide, their role consists in supporting the decision of one minority or another” (The Revolt of the Masses, pp. 128-129, 48). Also Schumpeter, Capitalism, Socialism, and Democracy, p. 263; Becker “Competition among Pressure Groups,” p. 392; Bennett, Public Opinion, pp. 230-232, 240-241, 306, 311; McClosky and Zaller, The American Ethos, pp. 11-12, 152, 234.

38. William Letwin, Law and Economic Policy in America: The Evolution of the Sherman Antitrust Act (Chicago: University of Chicago Press, 1965), p. 54. Thomas Dye cites a study by Warren E. Miller and Donald Stokes that “found very low correlations between the voting records of Congressmen and the attitudes of their constituents on social welfare issues, and even lower correlations on foreign policy issues. Only in the areas of civil rights did Congressmen appear to vote according to the views of a majority of their constituents.” Understanding Public Policy, 2nd ed. (Englewood Cliffs, N.J.: Prentice-Hall, 1975), p. 309. For opposing conclusions on the relation of ideology to congressional voting, see Sam Peltzman, “Constituent Interest and Congressional Voting,” Journal of Law and Economics 27 (April 1984): 181-210, and Keith T. Poole and R. Steven Daniels, “Ideology, Party, and Voting in the U.S. Congress, 1959-1980,” American Political Science Review 79 (June 1985): 373-399. Mismatches between the actions of legislators and the preferences of their constituents may reflect what voting theorists call the “cyclical majority phenomenon.” In this case, “No matter what is chosen, something else is preferred by a majority.” For a comprehensible explanation of this phenomenon, see Browning and Browning, Public Finance, pp. 62-65 (quotation from p. 62).

39. Nordlinger, Autonomy, p. 35. Also Joseph P. Kalt and M. A. Zupan, “Capture and Ideology in the Economic Theory of Politics,” American Economic Review 74 (June 1984): 279-300.

40. Alvin W. Gouldner, The Dialectic of Ideology and Technology: The Origins, Grammar, and Future of Ideology (New York: Oxford University Press, 1976), pp. 234-235; Peter Navarro, The Policy Game: How Special Interests and Ideologues Are Stealing America (New York: Wiley, 1984), p. 100. Compare John Kenneth Galbraith, The Anatomy of Power (Boston: Houghton Mifflin, 1983), pp. 48-49, 84-85.

41. Schumpeter, Capitalism, Socialism, and Democracy, pp. 129-130.

42. Hendrik Wilm Lambers, “The Vision,” in Schumpeter’s Vision: Capitalism, Socialism and Democracy after 40 Years, ed. Arnold Heertje (New York: Praeger, 1981), p. 120; Herbert K. Zassenhaus, “Capitalism, Socialism and Democracy: the ‘Vision’ and the ‘Theories,’” ibid., pp. 189-191; K. R. Popper, The Open Society and Its Enemies (New York: Harper Torchbooks, 1963), II, pp. 212-223.

43. Hoover, The Economy, Liberty, and the State, pp. 326-327. Also Peacock and Wiseman, The Growth of Public Expenditures, pp. 27-28, 66-67, and passim; Knight, Freedom and Reform, p. 404; Friedman and Friedman, Tyranny of the Status Quo, p. 8; Robert Higgs, “The Effect of National Emergency,” Pathfinder 4 (April 1982): 1-2; Peter Temin, “Government Actions in Times of Crisis: Lessons from the History of Drug Regulation,” Journal of Social History 18 (Sprint 1985): 433-438; Stephen Skowronek, Building a New American State: The Expansion of National Administrative Capacities, 1877-1920 (New York: Cambridge University Press, 1982), p. 10. For an excellent development of the Crisis Hypothesis by a political scientist, emphasizing the governmental consequences but not neglecting the economic aspect, see Clinton L. Rossiter, Constitutional Dictatorship: Crisis Government in the Modern Democracies (Princeton, N.J.: Princeton University Press, 1948). Impressive econometric support for a version of the Crisis Hypothesis has recently been presented by Karen A. Rasler and William R. Thompson, “War Making and State Making: Governmental Expenditures, Tax Revenues, and Global Wars,” American Political Science Review 79 (June 1985): 491-507.